Cypress Wealth Services

May 2020

One of the great things about history is that it allows us to learn from the past without making all the same mistakes again. When it comes to making financial decisions for the present and future, learning from the last recession is no different.

If you are feeling a little uneasy about how the markets have been acting recently, rest assured that basing your investment strategies off a track record of the last 50 years will ensure your financial safety. Sometimes making financial decisions that determine the quality of life you have in retirement is as simple as going back to the basics and remembering history. Let’s review 3 key financial lessons from the last recession that will help you move forward with confidence.

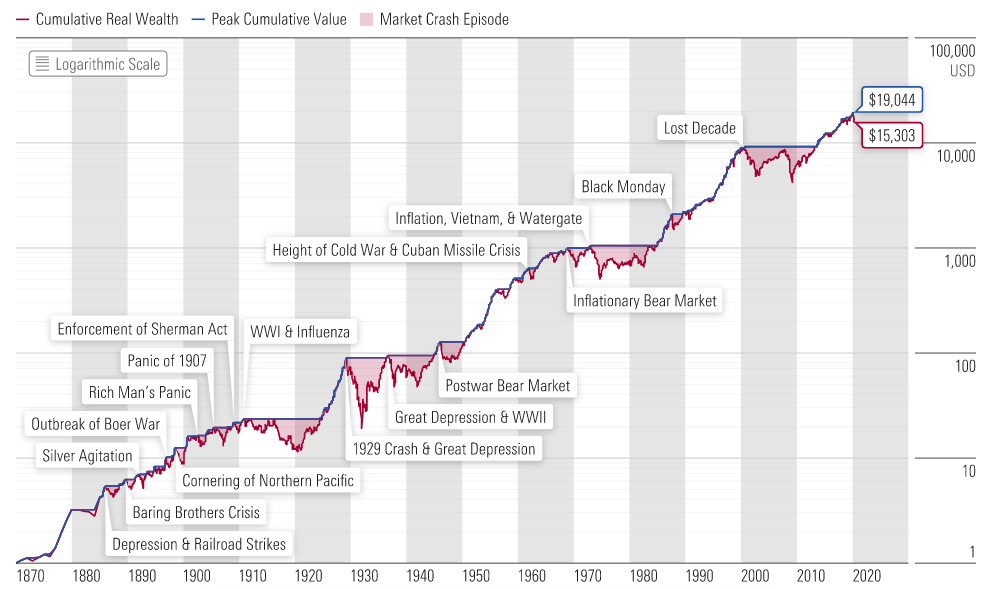

One of the first key points to remember when you see values in the market going down is to take a step back and remember that the markets always recover. Take a look at the graph below and notice the very steady upward trajectory over time; through wars, plagues, and most recently, the housing bubble from 2007-2009.

[1] https://www.morningstar.com/features/what-prior-market-crashes-can-teach-us-in-2020

In comparison, the market has gone through much worse economic seasons than the one we are currently in—and will do so again. There will be a constant ebb and flow of how much fluctuation occurs with all investments, but that’s why it is crucial for people to be aware of their true risk tolerance, rather than being fearful of what might happen. This leads to the next point, a great investment strategy to help align your investment portfolio with your risk level.

Since everyone has different thresholds for risk, it is essential to maintain the proper asset allocation based on your financial plan. This is done by focusing on diversification and rebalancing your investments once there is an understanding of what causes concern for you and how much risk you’re willing to incur.

To make it sound less stiff or complex, diversification is essentially the same concept as the saying “Don’t put all your eggs in one basket.” For example, instead of having all your money tied up in a few single stocks, you spread out those funds between different asset classes, like bonds, stocks, and real estate.

Rebalancing is maintaining a diversified portfolio through highs and lows of the market. For example, let’s say you want to have 70% of your investments in high-risk asset classes and 30% in low-risk but lower-return asset classes. When market prices go up for your high-risk investments, the percentage of your portfolio is closer to 80% high risk and 20% low risk. To rebalance your portfolio, you would sell a portion of those investments at a premium and reinvest that money into a lower-risk asset class to reach your desired ratio of 70/30.

One of the harsh realities that many learned in the last recession (and many are realizing again) is that debt is more than just money you must pay back; it carries risk. The more debt you have, the more risk you carry. Having debt increases your monthly living expenses, which puts unnecessary pressure on you and your family to sustain a lifestyle that you can’t afford if things aren’t going perfectly.

When you are approved for a certain amount of debt, that does not automatically mean it is in your best interest to borrow that much money. When job loss, reduced pay, or other emergencies come up, you are still responsible for paying all those loans back. Most importantly, your income is your largest wealth-building tool, so when too much of your income is going toward repaying your debt, it is difficult to increase your wealth.

There are some things we know intellectually but have a harder time putting into action. Have you been living out these lessons, or does there need to be a shift in your financial plan?

We at Cypress Wealth Services understand that no one person has the same risk tolerance or the same goals for their future. We want to understand more of what you need to feel comfortable with your finances right now and how best to help you succeed during this time, so contact one of our offices today. We look forward to hearing from you.

Cypress Wealth Services is an independent RIA firm providing financial planning and investment management to high net worth individuals, families, business owners, and institutions. Cypress Wealth Services comprises professionals with diverse backgrounds and extensive experience and qualifications. Cypress Wealth Services is uniquely qualified to serve a broad range of client needs, and their experience and expertise act as a foundation for their client service process. The firm uses The Second Growth, which focuses on efficiently protecting, growing, and transferring to their loved ones the wealth and legacy a person has already built. With offices in Palm Desert, CA, Tustin, CA, and Anchorage, AK, the firm serves clients across the country in Wealth Management Services, Fiduciary Services, 401(k) Design and Management, Investment Reporting Services, Financial and Retirement Planning, and more. For more information, visit www.CypressWS.com or call 760.834.7250.