Cypress Wealth Services

July 2023

You don’t need to be an economist to know that the last few years have been an incredibly shaky time for the markets in the United States. Because of this volatility, many people are trying to time their investments perfectly in order to avoid any sort of loss. No matter what decisions you’ve made to your investments in the last couple of years, timing the market is an extremely hard thing to do. To be honest, it doesn’t actually work. Here’s why.

Timing the market usually involves attempting to “buy low and sell high” by analyzing current market trends for inefficiencies or volatility indicators. This strategy may work sometimes, but it is far from perfect. Not only do you have to guess when to buy in, but you then have to guess when to sell. That means for every gain, you have to be right twice to make timing the market worth it. Unfortunately, market bottoms can only be truly spotted in hindsight, and timing the market is often closer to playing the lottery than it is to an educated guess.

Timing the market can also be expensive. Depending on your account type, asset class, and where you are executing your trades, you will likely be charged for every purchase and sale you make, and that’s on top of any taxes owed on gains. The more frequently you trade, the higher your transaction costs will be.

If you held the assets for less than a year, your gain will be taxed as ordinary income at your marginal tax rate, which can be as high as 37% for high-income earners. Long-term gains are taxed at a preferential rate. Regardless of your tax rate, your market timing must still be right more often than not just to cover the cost of your guess.

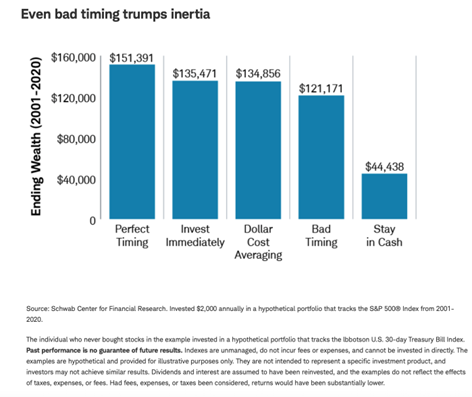

A recent study by Schwab Center for Financial Research found that bad market timing is worse than investing immediately, regardless of the market conditions at the time of investing. This indicates that even in market downturns, or just before a downturn, investors who invest immediately and remain invested will be better off than those who stay on the sidelines or attempt to time the market.

Take a look at Schwab’s graph below, which shows just how much more a fully invested portfolio earns over the course of 19 years. It would earn approximately $14,000 more in growth than a portfolio with bad market timing, and $91,000 more than a portfolio that stays in cash. The only investor who performs better is the one with perfect timing—but since we already know that perfect timing is impossible, investing immediately is the next best strategy.

What’s more, over time that extra $14,000 or $91,000 will have the opportunity to grow even more thanks to compounded interest. Even if the market fluctuates in the short term, the odds are high that a solid investment strategy will grow over time.

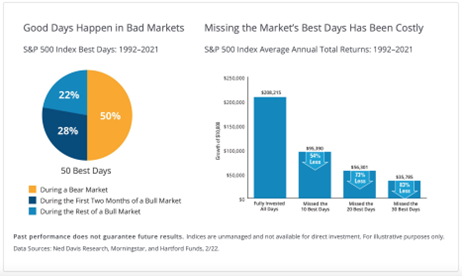

Another graph by Hartford Funds and Morningstar shows what happens if you miss the best days in the market, which often closely follow a major downturn and can be just as difficult to predict. An investor who missed the 10 best days in the market between 1992 and 2021 would have earned 54% less than someone who was fully invested during the same time period.

Someone who missed the 30 best market days would have earned a whopping $172,000 (83%) less than their fully invested counterpart. The research is based on a $10,000 initial investment, but these numbers would be much more dramatic if you were dealing with a $100,000 or even a $1,000,000 portfolio.

The time value of money tells us that a dollar today is worth more than a dollar tomorrow, and this is certainly the case when it comes to investing. The longer you are invested, the more likely you are to ride out the day-to-day market fluctuations and experience growth instead.

You might be holding your cards close to your chest waiting for the perfect opportunity, but there’s a good chance that in doing so, you’re robbing yourself of amazing opportunities for growth.

At Cypress Wealth Services, our dedicated goal is to make sure you don’t miss out on these opportunities to save for your future. When you partner with us you’ll have a knowledgeable and experienced team in your corner dedicated to simplifying the complex and bringing clarity and confidence to your financial journey. Don’t keep waiting to make a change for the better. Call us at 866.888.6563 or contact one of our offices today.

Cypress Wealth Services is an independent RIA firm providing financial planning and investment management to high-net-worth individuals, families, business owners, and institutions. Cypress Wealth Services comprises professionals with diverse backgrounds and extensive experience and qualifications. Cypress Wealth Services serves a broad range of client needs using their knowledge and expertise to act as a foundation for their client service process. The firm uses The Second Growth, which focuses on efficiently protecting, growing, and transferring the wealth and legacy a person has already built to their loved ones. With financial advisors in California, Alaska, Arizona, and Georgia, the firm serves clients across the country with Wealth Management Services, Fiduciary Services, 401(k) Design and Management, Investment Reporting Services, Financial and Retirement Planning, and more. For more information, visit www.CypressWS.com or call 760.834.7250.

Not all products and services referenced are available in every state and through every representative or advisor listed. Content, research, charts, tools, and stock symbols are for informational and educational purposes only and do not imply a recommendation or solicitation to engage in any specific investment strategy/ offering/ product/ plan feature or the other, nor can we guarantee the accuracy of such data. All investments involve risk, losses may exceed the amount of principal invested, and past performance does not guarantee future results. M.S. Howells & Co. & Cypress Wealth Services do not provide legal or tax advice. Check the background of the investment professional on BrokerCheck.finra.org or Adviserinfo.sec.gov. For additional information, please contact compliance@mshowells.com