Your Second Growth Newsletter

March 2022

Our mission is the help bring confidence and clarity to your financial life. A large part of that commitment is educating and being a positive sounding board during volatile times. The markets and world events have provided a lot to watch and process this past week.

First and foremost, our thoughts and prayers are with the people of Ukraine. It is terrible to watch what is happening. These events have added to the volatility that started in January and have created fear for many people. Our goal is to help our clients stay calm and keep a positive perspective as the markets work through these current events.

Your well-being is everything to us. If you have questions or concerns, please contact us anytime.

Volatility Can Be Uncomfortable but Normal

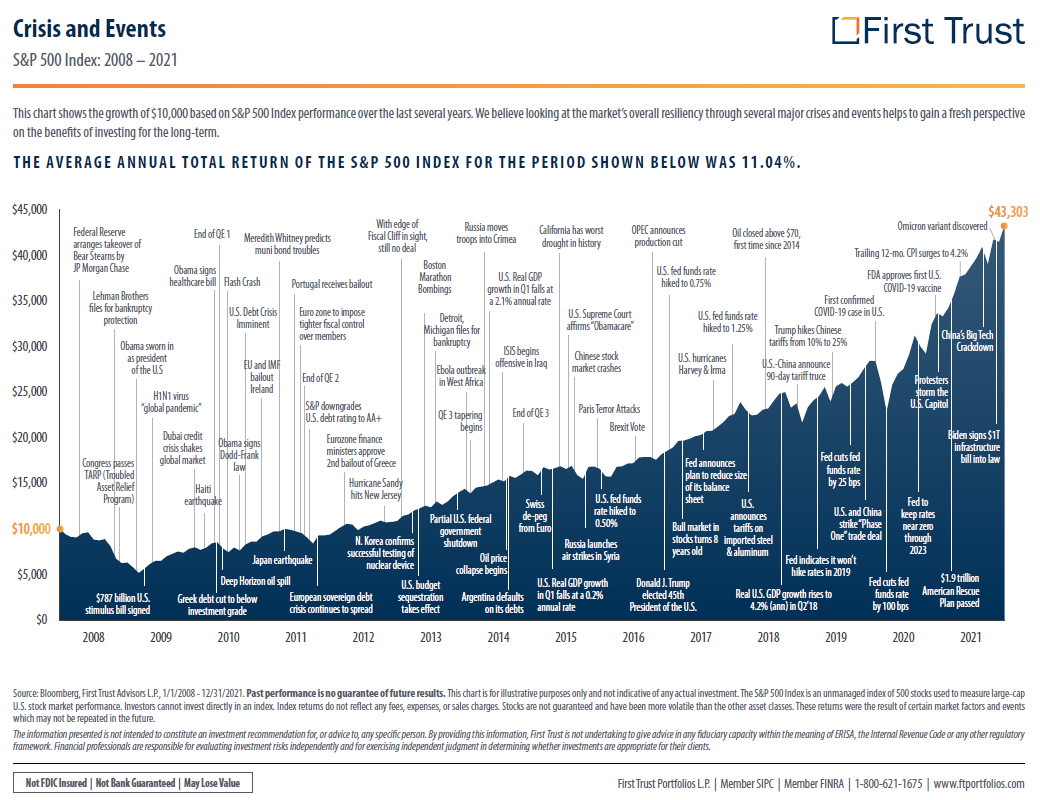

Volatility is normal, and it is normal to be uncomfortable. We understand the uneasiness or stress that might accompany volatile markets. Our job is to help bring perspective and help our clients manage these feelings. If we’ve learned anything from watching the markets, it is that volatility is normal. The chart below demonstrates past events, volatility, and market movement. In each case, volatility comes and goes.

We know it is normal to be uncomfortable with volatility because we are human. A couple of years ago, we hosted a workshop on behavioral finance called Biagnostics. The workshop focused on how our brains are wired and how our behavioral biases can impact our decision-making. We encourage you to revisit it as it is helpful to understand these concepts. In addition, we know that emotional investing can be costly, as illustrated below. If you would like a copy of the Biagnostics workbook, please contact us here.

Diversification and Rebalancing

What can you do to minimize the potentially negative effects of volatility? Two of the strategies we implement are diversification and rebalancing. Using both of these strategies helps address volatility and can be used as an opportunity. Diversification focuses on spreading your investments around so that your exposure to any one type of asset is limited. This practice is designed to help reduce the volatility of your portfolio over time. Rebalancing means buying and selling positions in your portfolio to get back to your original asset allocation. In addition, in non-qualified accounts, you can sometimes use rebalancing as a tax-loss harvesting strategy with assets that have diminished in value. If you have questions about any of these ideas, please contact us to discuss.

We are Here to Help

As 2022 continues to unfold, market uncertainty may continue. We are here to help you. Revisiting your financial plan, reviewing your asset allocation, or allowing us to be a sounding board for your concerns can be helpful. Please contact us anytime to discuss your needs.